In 2020, experts from Augusto & Co conducted a Pension survey. Results from the survey show that the number of people enrolling in the Nigerian Pension Scheme increased to only 9.2 million in 2020. Essentially, this result shows that a considerable number of Nigerians are yet to join a Pension Scheme to secure their future financially. Awabah is an organization that specializes in helping Nigerians to join the Micro Pension Scheme. Below is a detailed explanation of what you need to know about the company.

An Overview of Awabah

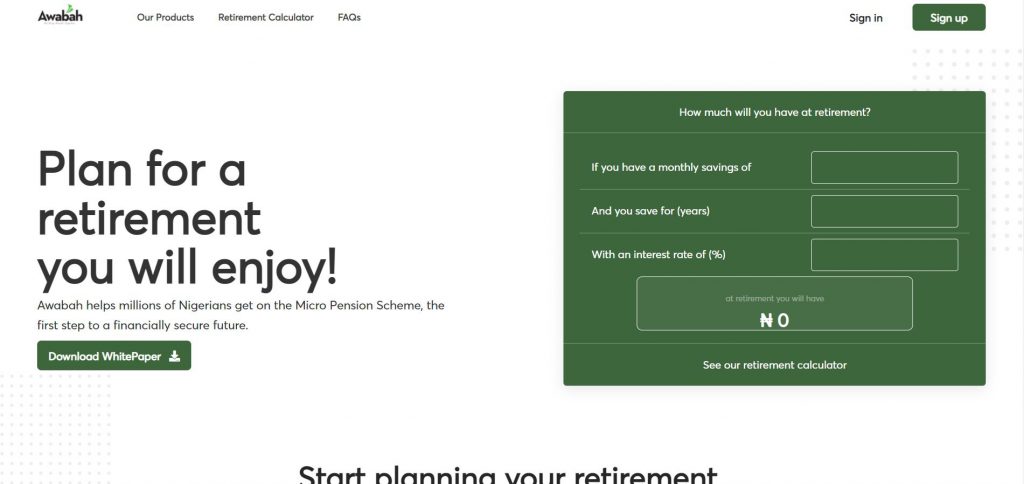

Awabah is a privately held digital pension platform for self-employed individuals. Basically, the organization provides micro pension services for people who are self-employed. A group of experts launched the platform in 2020 and it has been actively operating since then. Awabah makes planning for your retirement easier by doing the following:

1. They help you enroll for the Micro Pension Scheme as stated under the National Pension Commission.

2. The platform helps you to make active contributions directly to your retirement savings account.

3. Regularly monitor your retirement savings account. You can choose to receive updates through your text message or email.

Lastly, withdrawing funds from your retirement savings account directly from Awabah is easy and hassle-free.

What products does Awabah offer?

Basically, the digital platform offers you three products. They include:

1. Micro Pension plan

The Micro pension plan is a package under the Contributory Pension Scheme (CPS). Essentially, this package allows both the individuals working in companies with less than three staff and the self-employed to contribute towards their retirement. Hence, a Micro Pension Plan secures the financial future of these individuals when they cannot work due to old age or incapacitation. With Awabah, planning for this package is easy and flexible.

2. Awabah Contributions

This package allows you to save towards your goals. These goals can either be short or medium-term. The features of this plan include:

a. Interest rates that are competitive and benchmarked against the conventional Bank Savings Rate (BSR)

b. Flexibility of the package and your payment frequency. You can pay any amount you decide to whenever you want.

c. A 6-month tenure.

d. A minimum of N5, 000 per month.

3. Awabah Contribution Plus

Similar to Awabah Contributions, this package helps you to meet your long-term financial goals. The features of this package are the same as the Contributions Plan. However, you can contribute a minimum of N10, 000 with a 3-year minimum tenure.

Basically, these products sum up the offers Awabah has for Nigerians. Also, read more on the types of pension schemes in Nigeria.

Who is eligible to register for the Micro Pension Scheme wIth Awabah?

To apply for the Micro Pension Plan with Awabah, you must fulfill the following requirements:

1. You must be a Nigerian who is above 18 years of age.

2. You must be either self-employed or employed in an organization with less than 3 employees

Lastly, you must have no existing savings account in the Contributory Pension Scheme.

How can I register for the Micro Pension Scheme with Awabah?

To register for the Micro Pension Scheme, follow the steps below:

1. First, create an account with Awabah. To create an account, log into their official website, www.awabah.com, click on “sign up” and input your necessary details. Thereafter, the website will send a verification code to your phone number.

2. After you create an account, register for the Micro Pension Scheme using your account. The National Pension Commission will assign you a PENCOM number after your registration.

3. Lastly, you can start saving for the future in your Micro Pension Account.

Can I have more than one Retirement Savings Account with Awabah?

No, you cannot. You are entitled to just one Retirement Savings Account in your lifetime. This is a law in Nigeria.

How often can I contribute to my Micro Pension Plan under Awabah?

You can contribute whenever you wish to as long as it is convenient for you. Basically, you can contribute either daily, weekly, or monthly.

How can I contact Awabah?

You can contact Awabah through any of the following ways:

Office Address: 51, Moshalashi Street, Ikoyi 100001, Lagos

Phone Number: 0708 620 9827

Website: www.awabahng.com

Email Address: hello@awabahng.com

Bottom line

Awabah is a great platform that helps individuals join the Micro Pension Scheme with no stress. Also, the digital platform offers you other means of contributing towards your short or long-term goals. In all, the Micro Pension plan is a great way for every self-employed Nigerian to save towards retirement.

Need a loan? Kindly check out this platform that allows you to compare loans from several lenders in minutes. This would help you make the best decision for you.